Claims & Payment Information for Marketplace/On-Exchange Plans

Out-of-Network Liability and Balance Billing

Out-of-Network Coverage

- Out-of-network coverage refers to covered non-emergency or non-urgent treatment obtained without prior-authorization from a Non-Participating Provider when appropriate access to a Participating Provider is available.

To help minimize cost, Members should request pre-approval (authorization) from Sanford Health Plan when they would like to receive routine covered services from out-of-network providers.

If prior-approval is not requested and approved, members are subject to the out-of-network deductibles, coinsurance, and maximum out-of-pocket benefits. If the Member does not have out-of-network benefits, they may be responsible for the entire amount billed.

Members who live outside of the plan’s service area must use the plan’s participating providers as indicated in the plan materials and provider directory. The Member’s insurance ID card will display their network logo (such as PHCS, Multiplan, etc.) if they have options for care outside the plans’ service area. If the Member chooses to go to a non-participating provider when a participating provider is available, claims will be paid at the out-of-network benefit level if the Member has out-of-network benefits.

Balance Billing from Non-Participating Providers

Balance billing, sometimes referred to as surprised billing, is the practice of a medical provider charging a patient for the difference between the total cost of services being billed and the amount the insurance pays. When a member receives covered services from an in-network participating practitioner and/or provider, the member is protected from balance billing because the provider cannot attempt to collect charges above what we have reimbursed. When Sanford Health Plan does not have a contractual relationship in place and the provider is a non-participating provider, they may not accept Sanford Health Plan payment arrangements and members may be balanced billed for services received.

Members may be balance billed in some situations even when Sanford Health Plan covers all of the charges at an in-network level if the provider is a non-participating provider who will not accept our payment as full and final. Please check the Sanford Health Plan provider directory before receiving services to make sure you are seeing an in-network participating practitioner and/or provider.

Exceptions to Out-of-Network Liability

- Emergency Services: The Plan covers emergency services necessary to screen and stabilize members without pre-certification in cases where a prudent layperson, acting reasonably, believed that an emergency medical condition existed. In this case, a prudent layperson is anyone without medical training that draws on their practical experience when making a decision regarding the need to seek emergency medical treatment. Emergency services obtained from a Non-Participating Provider will be billed at the In-Network benefit level if a prudent layperson would have reasonably believed using a Participating Provider would have resulted in a delay that would worsen the emergency, or if a federal, state, or local law requires the use of a specific provider. The member or authorized representative must notify the Plan and member’s primary care physician, if one has been selected, as soon as reasonably possible and no later than 48 hours after physically or mentally able to do so.

For more information about balance billing, and what services Members cannot be balanced billed for per the No Surprises Act, visit https://www.sanfordhealthplan.com/no-surprises-act.

Member Claim Submission

Participating Providers

When Members receive services from a participating provider or obtain prescription drugs at network pharmacies, providers will file claims on behalf of the Member within 180 days of the service. Sanford Health Plan may deny claims by not filed within the 180-day window. If this occurs, charges that are denied may not be billed to the member.

If the Member does not provide their ID card at the time of service and the provider bills the wrong insurance company, the claim will be denied. The Member and provider will receive information explaining this denial, and the provider then takes responsibility for handling issues regarding the claim. If the 180-day filing period expires and the provider submits copies of documented attempts to obtain information from the Member and no response was given, then the Member may be responsible for payment of the claim.

Non-Participating Providers

Members may need to file a claim when receiving emergency services from Non-Participating Practitioners and/or Providers. Check with the Practitioner and/or Provider, as they may submit the claim to Sanford Health Plan on the members behalf. Members are responsible for making sure the claim is submitted to the Plan within one-hundred-eighty (180) days after the date that the cost was incurred. If the member or the Non-Participating Practitioner and/or Provider, does not file the claim within one-hundred-eighty (180) days after the date that the cost was incurred, the member will be responsible for payment of the claim.

If necessary, claims should be submitted to: Sanford Health Plan, PO Box 91110, Sioux Falls SD 57109-1110. A fillable claim form can be found here.

Marketplace (HealthCare.gov) Grace Period

Grace Period and Application

If the Member purchased their insurance coverage on the Marketplace (HealthCare.gov), they are receiving an advance premium tax credit (subsidy), and have previously paid at least one full month’s premium during the current benefit year, they will receive a 3 month (consecutive) grace period to pay missed premiums. Any claims received during the first month of the grace period will be paid, however, claims received during the 2nd and 3rd months will be held as “pending”. Claims that are pending will not be paid until delinquent premiums are paid in full.

How the Grace Period Works

- The monthly health insurance premium payment is due on the 1st of each month. If the payment is not received, the grace period begins for eligible policy holders. The Member’s policy will be considered delinquent on the last day of month where the premium was not paid in full and a delinquency notice is mailed to members.

- Members will receive notices the middle of the 2nd and 3rd months if premiums are not paid in full.

- If the full amount due (1st, 2nd, and 3rd month’s premium) is not received by the end of the 3-month grace period, the policy will be terminated effective the first day the account was considered delinquent (1st day of the 2nd month in the grace period). The Member would be responsible for any claims received while their account was in the pending status.

Retroactive Denials

Retroactive Denials are claims that were originally paid by the Plan, but are partially or full reversed at a later date after further review. In the case of a Retroactive Denial, the member will receive an explanation stating the previous charges paid by the Plan that are being reversed, and the reason for each reversal. After this occurs, the member is responsible for securing payment for any reversed charges.

Avoiding Retroactive Denials

There are a few ways that members can help themselves avoid these Retroactive Denials:

- Be sure to pay your monthly premium on time. If the plan pays on any claims when a Member’s policy is delinquent, payment of claims received during this time may be reversed. The Member would then be responsible for these claims.

- If the Member has health coverage through multiple policies, ensure each company has information about both policies. If a Member is found to have multiple policies after a claim has been paid by Sanford Health Plan, there may be a reversal of some or all of the charges.

- Ensure all information that is provided to Sanford Health Plan for a pre-approval (authorization) request is correct. If information in a prior-authorization is found to be fraudulent, any claims that were paid based on the prior-authorization may be partially or fully reversed.

Member Recoupment of Overpayments

Premium refunds will be processed for the following reasons:

- The Member has prepaid premiums beyond the end of the month in which a cancellation or termination occurred.

- The Member requests a refund of an overpayment made in error.

Members can call Sanford Health Plan customer service to request a refund if they believe they have overpaid their premium due.

Medical Necessity, Pre-Approval (Authorization) Timeframes & Member Responsibilities

Pre-Approval (Authorization)

Pre-approval (authorization or certification) is the approval of a requested service for medical care prior to receiving the service. Pre-approval is designed to aid early identification of a treatment plan to ensure medical management and available resources are provided throughout an episode of care. If medical care requires pre-approval, the member is ultimately responsible for obtaining it from Sanford Health Plan to receive in-network coverage per their benefit plan. Information supplied by a provider’s office will also satisfy this requirement. Failure to obtain pre-approval will result in a denial or payment at a reduced level. If the Member’s plan does not provide out-of-network coverage, benefits are not payable when the member fails to obtain pre-approval.

The plan determines approval for prior authorization based on appropriateness of care, service, and existence of coverage. Pre-approval is required for all inpatient admissions of members. See your plan documents for full details and a list of all services requiring pre-approval.

Time Frame Needed for Pre-Approval

Member Responsibility:

All requests for pre-approval (authorization or certification) are to be made by the Member at least three (3) business days prior to the requested service. Admission before the day of non-emergency surgery will not be authorized unless early admission is medically necessary and approved by the plan. Coverage for hospital expenses prior to the day of surgery will be denied unless authorized prior to being incurred.

Health Plan Responsibility:

Sanford Health Plan will review the Member’s request against standard medical necessity criteria. A determination for elective care will be made within fifteen (15) calendar days of receipt of the request. If the plan is unable to make a decision due to matters beyond its control, it may extend the decision time frame once, for up to fifteen (15) calendar days. In this case, Sanford Health Plan will notify the Member within the first fifteen (15) days after initial receipt of the request, and will provide an approximate date by which it expects to make a decision.

If the plan is unable to make a decision due to lack of information on elective requests, the plan may extend the decision period once for up to fifteen (15) calendar days. In this case, the Member will be contacted within the first fifteen (15) days after the initial receipt of request. The Member has 45 calendar days to provide the requested information. The actual extension period for Sanford Health Plan begins when the information is resubmitted (even if it is not correct), or at the end of the 45-day period that the Member has to resubmit information.

For urgent or emergent care needs, Sanford Health Plan will make a determination within 72 hours after receipt of request. If the plan is unable to make a decision due to lack of information, it may extend the decision time frame once for up to an additional 48 hours. In this case, the Member will be contacted within the first 24 hours after receipt of request. The Member then has 48 hours to submit correct information. The actual time extension for Sanford Health Plan begins either when the information is resubmitted (even if it is not correct), or when the 48-hour time period expires for the Member to resubmit information.

Medical Necessity

Medical necessity means the Member will receive health care services that are appropriate in terms of type, frequency, level, setting, and duration to the member’s diagnosis or condition, diagnostic testing and preventive services. The criteria used to determine whether a service, treatment, technology, prescription drug or supply is medically necessary, are:

- Must be consistent with generally accepted standards of medical practice as recognized by the plan, as determined by health care practitioners in the same or similar specialty as typically manages the condition, procedure, or treatment or issue.

- Help restore or maintain the Member’s health.

- The services are required for reasons other than the convenience of the covered person of their provider, or solely for custodial, comfort, convenience, appearance, educational, recreational or vocational reasons.

- Prevent deterioration of the Member’s condition.

- Prevent the reasonably likely onset of a health problem or detect an incipient problem.

- Not considered experimental or investigational unless part of an approved clinical trial.

Drug Exception Timeframes and Member Responsibilities

Exceptions and Member Responsibilities

Members are required to use medications on the Sanford Health Plan formulary, which is a list of FDA-approved brand name and generic medications chosen by health care providers on the Physician Quality Committee. Members are allowed to request and gain access to clinically appropriate drugs not covered under the formulary and may request an exception for:

- A non-covered medication or drug; or

- A medication or drug not currently listed in the Sanford Health Plan Formulary

A provider or Member should contact the Pharmacy Management Department to request coverage for the specific medication or drug. This can be done via a phone call, online fillable form submission (available to members when they log into their account), or letter of medical necessity requesting coverage for the specific medication or drug. The plan will use designated Pharmacy Management Department staff and/or appropriate practitioners to consider exception requests and promptly grant an exception to the formulary, including exceptions for anti-psychotic and other drugs to treat mental health conditions, for a Member when the provider prescribing the medication indicates to the plan that:

- The formulary drug causes an adverse reaction;

- The formulary drug is contraindicated (should not be used); or

The prescription drug must be dispensed as written to provide maximum medical benefit to the Member.

NOTE: Members must generally try formulary medications before an exception for the formulary will be made for non-formulary medication use.

Timeframe

- For expedited (emergent) requests, the plan will make a coverage determination no later than 24 hours after receiving the request and notify the Member and/or the provider.

- For standard requests, the plan will make a coverage determination within 72 hours of receiving the request and notify the Member and/or the provider.

Approved or Denied

- If a standard (non-emergent) request is approved, the plan will provide coverage of the non-formulary drug for the duration of the prescription, including refills. If an expedited (emergent) exception request is approved based upon exigent circumstances, the plan will provide coverage of the non-formulary drug for the duration of the exigency.

- If the request is denied, the Member and provider will be given a reason for the denial by phone and in writing. If a member feels the non-formulary request has been denied incorrectly, they may ask the plan to submit the case for an external review by an impartial, third-party reviewer known as an independent review organization (IRO). The plan must follow the IRO's decision.

- An IRO review may be requested by a member, member's representative, or prescribing provider by calling, or mailing the request to:

Sanford Health Plan

300 Cherapa Place, Suite 201

PO Box 91110

Sioux Falls, SD 57103

Phone: (800) 752-5863 (toll-free) | TTY: 711 (toll-free)

Members may also contact their state’s Division of Insurance. Members should refer to their policy for additional details on this process.

Explanation of Benefits (EOBs)

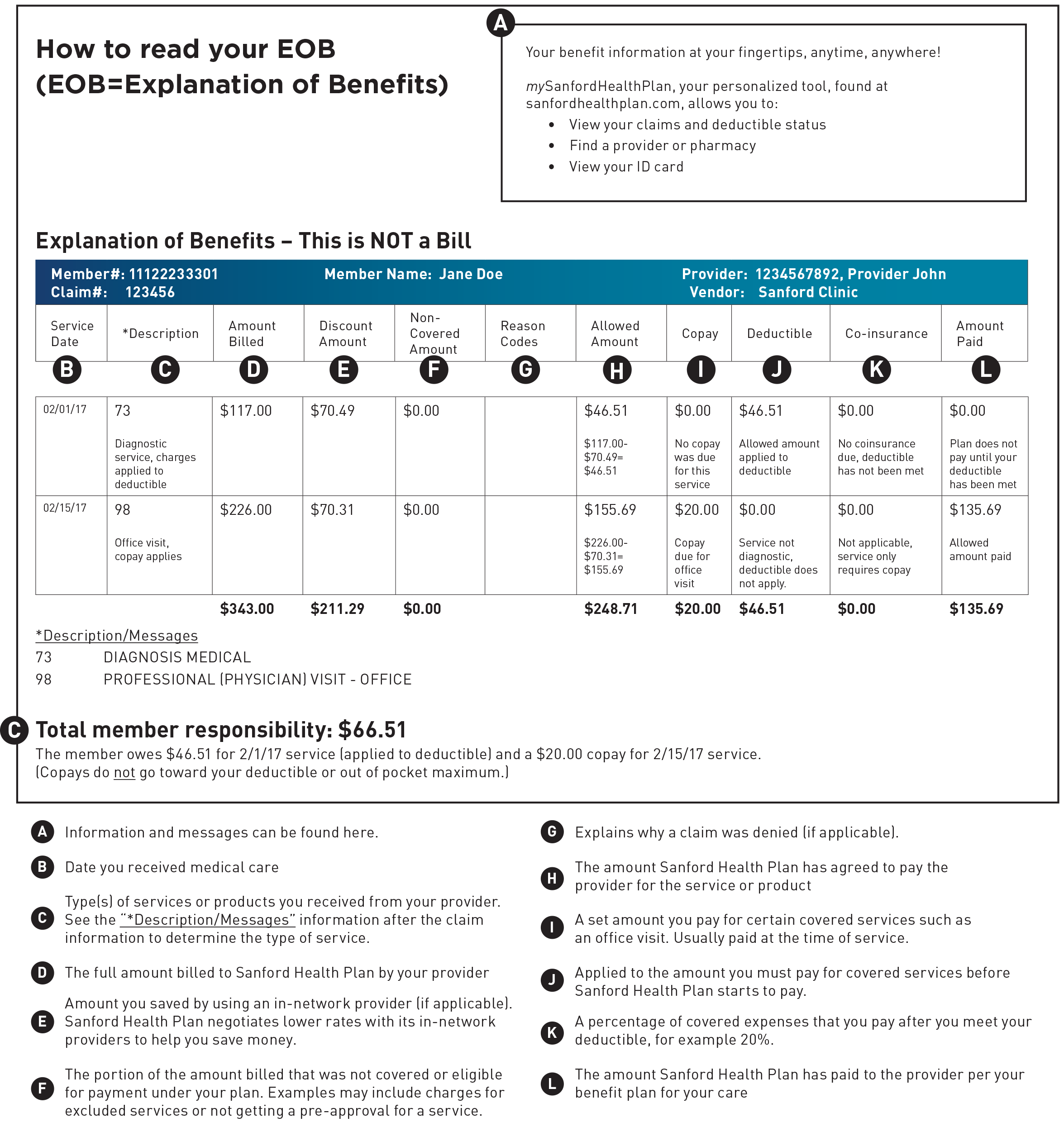

After a member’s claim is processed, Sanford Health Plan sends the Member and the provider an EOB outlining the charges that were covered. The purpose of an EOB is to show how the plan paid for the Member’s services; it shows the amount billed and how that amount is applied to deductible, coinsurance or copayments, or if any of the charges were for non-covered services. Please reference the graphic below for specific information regarding what is feature on an EOB.

Coordination of Benefits (COB)

If a member is covered by another health plan, insurance, or other coverage arrangement, the plans and/or insurance companies will share or allocate the costs of the Member’s health care by a process called “Coordination of Benefits” so that the same care is not paid for twice. The Member has two obligations concerning Coordination of Benefits (“COB”):

- The Member must inform Sanford Health Plan of any other plans that provide health care for the Member, and

- The Member must cooperate with the plan by providing any requested information.

Ordering of Benefits

The order of benefit determination rules governs the order in which each plan will pay a claim for benefits. The plan that pays first is called the primary plan. The primary plan must pay benefits in accordance with its policy terms without regard to the possibility that another plan may cover some expense. The plan that pays after the primary plan is the secondary plan. The secondary plan may reduce the benefits it pays so that payments from all plans does not exceed 100% of the total allowable expense. Refer to your plan documents for more detailed information.